Welcome to our complete manual on information First Data Merchant Services bills and expenses for your financial institution statement. If you’ve ever come upon the abbreviation ‘First Data Merchant Services’ or ‘FDMS Payment’ on your bank statement and questioned what it indicates, you are in the proper place. In this guide, we’ll delve into the arena of FDMS payments, demystifying what they may be, why they seem on your statement, and how to manipulate them efficiently. First Data Merchant Services, or First Data Merchant Services, is a distinguished participant within the fee processing enterprise, facilitating electronic transactions for agencies of all sizes across numerous sectors.

Whether you are making purchases at your favored retail shops, eating out at restaurants, or purchasing online, First Data Merchant Services may be concerned with processing the transactions. Understanding First Data Merchant Services bills is crucial for both clients and groups, because it empowers individuals to recognize legitimate transactions, detect potential fraud, and manipulate their price range with self-belief. Let’s embark on this adventure to resolve the mysteries of First Data Merchant Services bills together.

What is FDMS Payment?

FDMS Payment refers to transactions processed through First Data Merchant Services (FDMS), one of the global’s leading charge processing corporations. First Data Merchant Services gives companies the infrastructure and generation needed to accept electronic bills, which include credit and debit card transactions, online payments, and different forms of digital trade.

When you spot ‘FDMS’ for your financial institution declaration, it signifies that a transaction has been performed via FDMS’s payment gateway. This ought to encompass purchases made at retail stores, online buying, eating at eating places, or some other transactions wherein a card fee is worried.

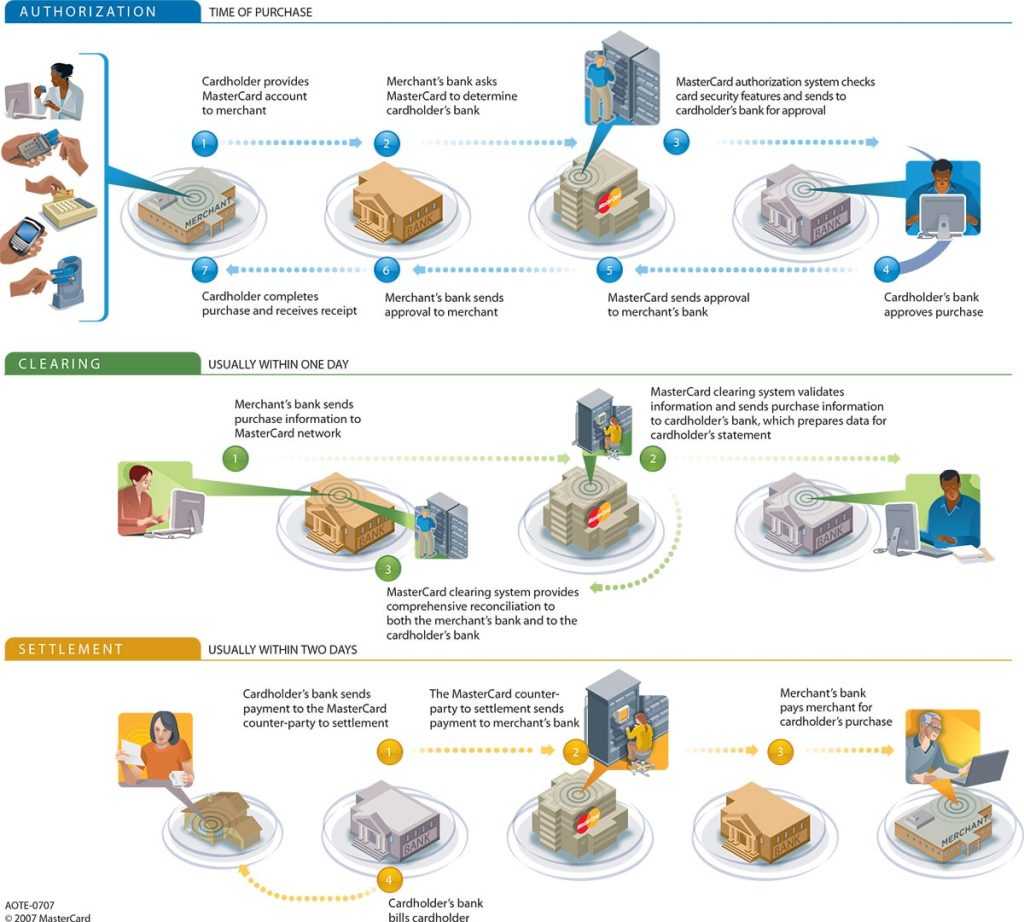

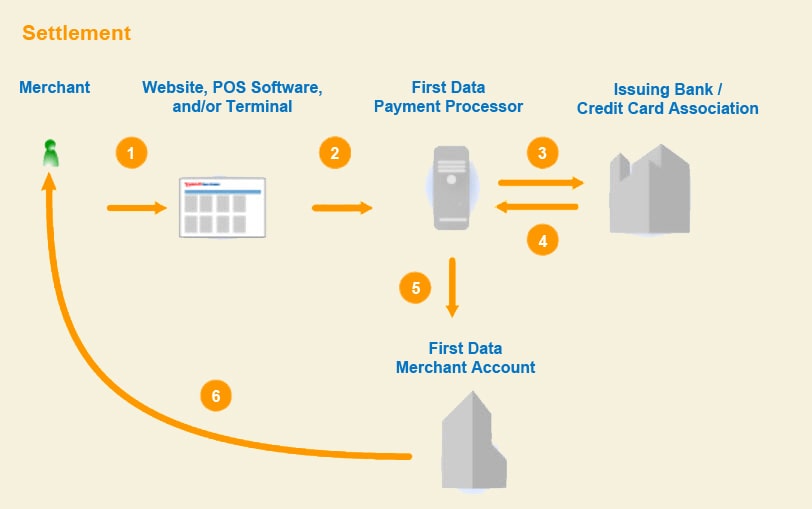

First Data Merchant Services acts as an intermediary between traders (agencies) and financial institutions, facilitating the authorization, processing, and settlement of transactions. They take care of the steady transmission of payment records, verification of cardholder information, and routing of price ranges between the client’s financial institution and the service provider’s account.

In essence, FDMS is a manner for organizations to soundly and efficiently method electronic payments, offering convenience for both traders and customers alike. It permits organizations to expand their price alternatives, enhance cash waft, and streamline their operations, whilst additionally imparting consumers the ease of making purchases using diverse price techniques.

Why You Might See FDMS Payment on Your Bank Statement:

You might see First Data Merchant Services in your financial institution declaration for numerous motives:

- Merchant Transactions: FDMS Payment frequently appears for your financial institution declaration whilst you make purchases or transactions at businesses that use First Data Merchant Services as their payment processor. This ought to consist of retail shops, eating places, online retailers, service carriers, and more. When you use your credit or debit card for the price, First Data Merchant Services facilitates the transaction procedure, and the fee may additionally appear in your announcement as ‘First Data Merchant Services.’

- Online Purchases: Many e-trade websites and online retailers make use of First Data Merchant Services’s charge gateway to safely system online payments. When you are making purchases online with the use of your credit score or debit card, First Data Merchant Services may additionally cope with the transaction, resulting in the arrival of ‘FDMS Payment’ in your bank statement.

- Subscription Services: If you have routine subscription offerings that are processed through First Data Merchant Services, consisting of streaming systems, software subscriptions, or membership charges, you can see ‘FDMS’ in your financial institution announcement every time the subscription is billed.

- Third-party Payments: In some instances, third-party price processors or financial institutions might also use First Data Merchant Services to technique transactions on behalf of traders. If you are making payments via these third-birthday party systems, First Data Merchant Services may also seem for your statement as the processing entity.

- Authorized Transactions: Occasionally, you can see pre-authorizations or holds for your account for pending transactions. These brief holds are regularly related to First Data Merchant Services till the transaction is finalized, at which point the real rate might be pondered on your assertion.

Identifying FDMS Payment on Your Bank Statement

Identifying First Data Merchant Services on your financial institution assertion is vital for expertise in your monetary transactions correctly. Here are a few guidelines to help you apprehend FDMS:

- Check Transaction Descriptions: Look for entries for your bank declaration that consist of terms that include ‘FDMS Payment,’ ‘First Data Merchant Services Deposit,’ or versions thereof. These descriptions regularly suggest transactions processed through FDMS’s payment gateway.

- Review Transaction Codes: In addition to descriptive labels, transactions processed through First Data Merchant Services can also have precise codes associated with them. Familiarize yourself with the codes usually used by First Data Merchant Services to pick out their transactions, which allow you to pinpoint First Data Merchant Services-related costs on your declaration.

- Cross-reference with Receipts: If you have receipts or statistics of new transactions, pass-reference them together with your financial institution declaration to become aware of First Data Merchant Services. Compare the transaction amounts, dates, and merchant names in your receipts with the corresponding entries on your announcement to verify First Data Merchant Services transactions.

- Look for Patterns: Be aware of recurring transactions or styles in your banking hobby that involve First Data Merchant Services. If you frequently keep at certain shops or use particular online services that utilize First Data Merchant Services for charge processing, you could see a regular presence of First Data Merchant Services entries for your statement.

- Contact Customer Support: If you’re unsure about a specific entry for your bank declaration or need an explanation, do not hesitate to reach out to your financial institution’s customer service crew. They can help in identifying FDMS and offer insights into your transaction history.

Understanding Charges Associated with FDMS Payment:

Understanding the costs associated with First Data Merchant Services is vital for dealing with your price range efficiently. Here’s what you need to recognize approximately the various charges that may be related to FDMS transactions:

- Transaction Fees: First Data Merchant Services usually fees transaction costs for processing bills on behalf of merchants. These expenses can vary depending on factors inclusive of transaction volume, card sorts (credit score, debit, global), and processing strategies (swipe, chip, contactless, online). Transaction costs are normally calculated as a percent of the transaction amount plus a fixed quantity consistent with the transaction.

- Monthly Service Fees: Some merchants may also incur monthly provider prices for using First Data Merchant Services’s fee processing services. These charges cover ongoing assistance, upkeep, and access to First Data Merchant Services’s fee infrastructure. Monthly provider fees can vary depending on the service provider’s business length, industry, and particular service package.

- Equipment Costs: Merchants may additionally need to buy or hire fee processing gadgets, inclusive of point-of-sale (POS) terminals or card readers, from FDMS. Equipment costs can vary depending on the sort and quantity of gadgets required and any extra features or functionalities.

- Chargeback Fees: In the event of a chargeback (a disputed transaction initiated by the cardholder), FDMS can also charge a charge to the merchant for managing the dispute procedure. Chargeback charges cowl administrative charges related to investigating and resolving the dispute, regardless of the final results.

- Miscellaneous Fees: First Data Merchant Services may investigate extra charges for diverse offerings or instances, along with dealing with verification service (AVS) expenses, batch processing fees, PCI compliance costs, and announcement charges. These charges are commonly charged on a keeping-with-transaction or consistent-with-month foundation and can upload up over the years.

It’s crucial to check your service provider settlement with First Data Merchant Services carefully to apprehend the unique fee structure and phrases relevant to your account. By knowing the charges associated with First Data Merchant Services, merchants can assess the fee of accepting digital payments and make informed selections concerning their price processing techniques.

Why Clarity Matters: Avoiding Confusion and Fraud:

Clarity concerning FDMS bills is critical for each client and trader to avoid confusion and save you from fraud. Here’s why:

- Understanding Transactions: Clear verbal exchange and know-how of First Data Merchant Services help clients understand legitimate transactions on their bank statements. By knowing what to anticipate and the way transactions are processed, clients can perceive unauthorized fees or discrepancies more effortlessly.

- Detecting Fraudulent Activity: Without clarity on FDMS payments, customers may also neglect fraudulent fees or unauthorized transactions on their financial institution statements. Fraudsters often cause the most confusion or lack of awareness to perform unauthorized transactions, making it vital for purchasers to live vigilant and verify all fees.

- Protecting Financial Information: Clear verbal exchange approximately First Data Merchant Services bills helps clients understand how their financial information is treated and processed throughout transactions. This focus empowers clients to protect their touchy facts and take vital precautions to shield against identification robbery or fraud.

- Resolving Disputes: In the occasion of billing mistakes or disputed transactions, clarity concerning First Data Merchant Services streamlines the decision technique. Consumers can offer targeted facts about the transaction in query, making it simpler for banks and merchants to investigate and clear up disputes efficiently.

- Maintaining Trust and Confidence: Transparent and clear conversation about First Data Merchant Services bills fosters consideration and self-assurance amongst consumers, traders, and economic institutions. When customers experience assurance within the protection and integrity of their transactions, they are much more likely to interact in electronic payments and guide businesses that prioritize transparency and responsibility.

Tips for Managing FDMS Payments:

- Keep Detailed Records: Maintain prepared records of all First Data Merchant Services transactions, such as receipts, invoices, and bank statements. This documentation can help reconcile debts, tune fees, and pick out any discrepancies or irregularities.

- Monitor Transaction Activity: Regularly evaluate your financial institution statements and transaction records to reveal First Data Merchant Services and identify any unauthorized or suspicious prices. Promptly record any discrepancies for your bank or FDMS to cope with capability troubles quickly.

- Understand Fee Structures: Familiarize yourself with the rate systems associated with FDMS bills, which include transaction costs, monthly service charges, and other applicable prices. Understanding these costs can help you expect expenses and manage your budget extra successfully.

- Optimize Payment Processing: Explore ways to optimize your charge processing to reduce costs and streamline operations. This may consist of consolidating transactions, leveraging batch processing, or negotiating lower prices with First Data Merchant Services based totally on your commercial enterprise volume and wishes.

- Stay Compliant: Ensure compliance with relevant guidelines and standards, together with Payment Card Industry Data Security Standard (PCI DSS) requirements, to guard sensitive fee facts and mitigate safety dangers. Implement security features inclusive of encryption, tokenization, and normal safety audits to shield against data breaches and fraud.

Real-life Scenarios: Examples and Case Studies:

Real-lifestyle eventualities and case studies provide precious insights into the sensible implications of FDMS. Here are a few examples illustrating how people and corporations navigate First Data Merchant Services transactions in their day-to-day operations:

- Small Business Owner’s Experience: Sarah, a small enterprise owner, relies on First Data Merchant Services to procedure bills for her online boutique. She encountered a venture when she noticed discrepancies between her income facts and financial institution statements. Through diligent document preservation and conversation with the First Data Merchant Services guide, Sarah identified a technical glitch that was causing delays in transaction settlements. By running intently with First Data Merchant Services to solve the issue, Sarah was able to streamline her charge processing and ensure correct financial reporting for her enterprise.

- Restaurant’s Payment Processing: Jake manages a busy eating place that stories high volumes of card transactions every day. To optimize payment processing and reduce prices, Jake applied techniques inclusive of batch processing and negotiated lower transaction expenses with First Data Merchant Services. By leveraging reporting tools furnished by FDMS, Jake won insights into peak transaction instances and patron options, permitting him to regulate staffing ranges and menu services as a consequence to beautify purchaser pride and profitability.

- Consumer Dispute Resolution: Emily, a patron, located an unauthorized charge categorized as ‘FDMS Payment’ on her financial institution declaration. Concerned approximately capability fraud, Emily right away contacted her financial institution to dispute the price and initiated a chargeback request. The bank investigated the transaction and determined that it was indeed fraudulent. With the financial institution’s help, Emily’s finances have been refunded, and additional safety features have been carried out to save you destiny unauthorized transactions.

Conclusion:

In the end, the know-how of FDMS payments is important for both clients and businesses to navigate the complexities of digital transactions expectantly. By demystifying First Data Merchant Services expenses, people can apprehend valid transactions, detect fraudulent pastimes, and effectively manipulate their finances. For merchants, clear communique, proactive management, and optimization of price processing techniques are key to maximizing performance and minimizing expenses.

Transparent verbal exchange among customers, traders, and price processors fosters consideration, enhances safety, and guarantees a seamless financial level for all events concerned. With a solid knowledge of FDMS bills and adherence to best practices, people and businesses can navigate the virtual charge panorama comfortably, empowering them to make informed choices and guard their monetary well-being.

FAQs:

Q1: What is FDMS, and why do I see it on my bank declaration?

Ans: FDMS stands for First Data Merchant Services, a main payment processing employer. You may additionally see ‘First Data Merchant Services’ or ‘FDMS Payment’ in your financial institution announcement when you make purchases or transactions at corporations that use First Data Merchant Services as their charge processor.

Q2: I don’t recognize a charge categorized as ‘FDMS Payment’ on my announcement. What must I do?

Ans: If you come across a strange First Data Merchant Services rate in your financial institution assertion, it’s critical to research in addition. Start by checking your receipts or transaction facts to verify the legitimacy of the rate. If you continue to have questions, contact your bank or First Data Merchant Services customer service for assistance.

Q3: Can First Data Merchant Services charges be disputed?

Ans: Yes, First Data Merchant Services prices can be disputed if you believe there has been an error or unauthorized transaction. Contact your financial institution as quickly as possible to provoke the dispute procedure. Provide any relevant documentation or evidence to guide your declaration, and the bank will inspect the problem on your behalf.

Q4: How can I contact FDMS for help or inquiries?

Ans: You can reach First Data Merchant Services customer support by telephone or electronic mail, relying on the contact statistics furnished on their internet site or your merchant settlement. Be organized to provide info including your account data, transaction details, and any applicable documentation while contacting First Data Merchant Services For assistance.

Q5: Are there any costs related to First Data Merchant Services bills?

Ans: Yes, FDMS may charge charges for processing transactions, monthly carrier fees, gadget charges, and different miscellaneous prices. The specific price structure might also range relying on elements including transaction extent, card types, and processing techniques. Review your service provider settlement with First Data Merchant Services for info on applicable prices.

READ MORE: Unveiling the Wonders of Fenix Internet: A Comprehensive Guide