Have you filed your tax return this year? Do you know there is always a penalty for the late filing of your return? Government matters always seem to be grave and entail a lot of seriousness when executing their projects. There are laid down procedures to end your process successfully when it comes to government issues.

And, filing a return is one of the main processes that the government takes into consideration. Here, you must provide authentic details, your documents must tally with your area or residence, and your email address and sometimes your current phone number might be of the essence to them.

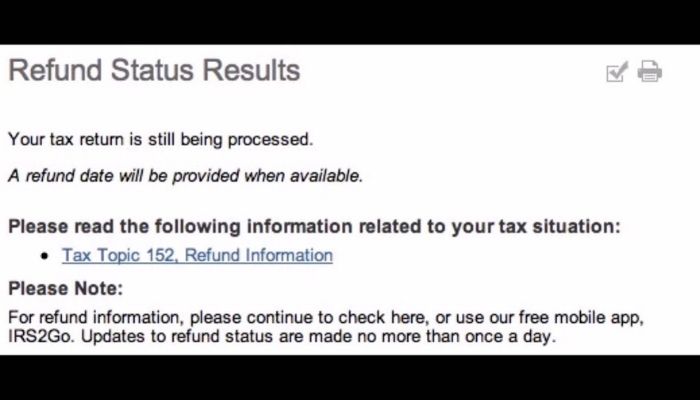

However, the IRS tax message, “Your tax return is still being processed. A refund date will be provided when available” has left individuals in awe. As people are committed to returning filling, the majority are in a state of flux, they don’t know why it has taken long for their return to be processed and approved.

Maybe, it is because of the pandemic that is ravaging the whole world. Everything is distorted and when an ounce of government pillars is shaken, they tend to take years to restore things to normal.

Similarly, not everyone is experiencing a delay. We can’t take the government as a scapegoat for all the delays. There might be other reasons why your return might delay to be processed and be approved by the IRS.

IRS (Internal Revenue Service) is a government agency in the U.S that deals with tax collection and implementation of tax laws. In any case, if you experience a delay in your return, this body is responsible for all your details processing and approval.

Therefore, before we delve much into the IRS tax message,” Your tax return is still being processed. A refund date will be provided when available,” means, it is prudent to highlight why your tax refund might experience delay and fail to be processed at the end.

If this is you searching to know why your tax refund has failed to be processed and what their processing message normally indicates, you are lucky to meet this post. Below are the top reasons for encountering delay in your refund;

- Errors in your tax return

- Failing to complete all the processes required.

- Fraud denoted in your return

- Any claim from an authentic organization can lead to a delay in your return approval.

After you’ve acquainted yourself with the tenets that necessitate a delay in your return approval and processing, on the flip side, getting a message from the IRS reading, “Your tax return is still being processed. A refund date will be provided when available,” indicates the following;

- Your return is being processed by IRS

- Refund approval

- Preparation to receive a refund to your bank from IRS

Your return is being processed by IRS Tax:

After a clear examination of your documents, the IRS can fully process your refund. Processing your refund by the IRS is not a rocket science task. What you present to them matters a lot.

As a government thing, they must cross-check all your data in their system to clear their doubts and ascertain what you have presented is clean and lack common errors experienced by the majority such as incorrect mail and fraud that is rife nowadays.

Refund approval

When you receive the IRS tax message, “Your tax return is still being processed. A refund date will be provided when available,” primarily denotes that your refund has been approved and is readily available on the due date.

When your return is full of errors, the IRS under their enforcement laws can hold your money until you provide legit and approved documents by the government.

Preparation to receive a refund to your bank from IRS Tax:

Nothing elates individuals when they know in the next minutes or month they are going to receive funds. This is the basic nearly everybody is struggling to have.

However, the IRS under its laws will never prepare to send you money into your bank directly if your return is laced with fraud or unknown errors. Following their steps successfully can assure you receive your fund effortlessly.

Bottom-Line

Confining yourself with government enforcement laws is somewhat important. You’ll never find yourself in a mess, or delays with your tax refund. Since the IRS is governed by the government, what they do is by their enforcement laws.

Be keen when submitting your tax forms, and rest assured of a successful refund of your tax.

READ MORE: Are Real Estate Investment Trusts A Good Career Path?